Why Invest in the UAE

Own your Property in UAE's Fastest-Growing Investment Zones

Why Invest in the UAE

High Rental Yields

Earn 7–11% annual returns in high-demand areas driven by strong tenant demand.Tax-Free Returns

Zero property tax, income tax, or capital gains tax means higher net profits.100% Foreign Ownership

Buy freehold property with full ownership and no local partner required.Golden Visa Eligibility

Property investment can qualify you for 5 to10 year UAE residency.Strong Capital Appreciation

Prime locations show 8 to12% annual price growth.Sustained Market Demand

Tourism growth, population inflow, and business expansion fuel rentals and sales.Secure & Regulated Market

Transparent laws and government oversight protect investor interests.

Start Your Investment Journey with REMAX Zam Today!

- Click to Call

- zam@remax.ae

- Click to Whatsapp

Explore High ROI Properties in UAE

Why Invest with REMAX ZAM

We offer honest guidance, not pushy sales. Our experts curate pre-vetted projects with strong ROI, assist from inquiry to deal closure, and help you build a long-term UAE investment strategy.

- Expert Market Knowledge

- High Portfolio of Properties

- Global Brand Presence

- End to End Support

- Honest & Transparent Process

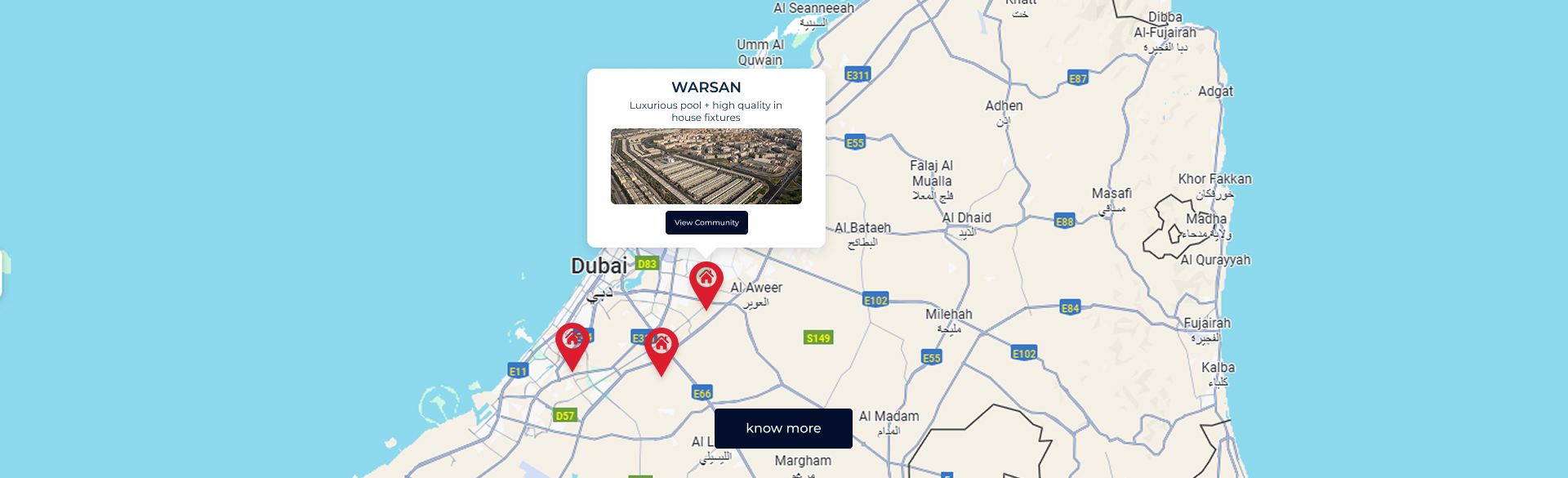

Discover Your Investment Location

FREQUENTLY ASKED QUESTIONS

The UAE offers a stable economy, tax-friendly environment, strong infrastructure, and high rental yields, making it one of the most attractive real estate investment markets globally.

Dubai, Abu Dhabi, and select emerging emirates provide high capital appreciation potential and strong rental demand, catering to both short-term and long-term investors.

Studios, 1–3 bedroom apartments and select villas in prime locations often offer the highest rental yields and steady capital growth.

Yes, foreign nationals can own freehold properties in designated areas with full legal ownership and rights.

Rental yields vary by location and property type, but investors can expect competitive returns compared to other global markets, often ranging from 6% – 10% annually.

Buyers generally need a valid passport, to be at least 21 years old, and have funds or approved financing; UAE residency is not mandatory in most emirates.

Developers or banks may ask for additional KYC documents such as proof of address and income for financed purchases.

Many investors use property management services to handle rentals, maintenance, and tenant relations, ensuring hassle-free ownership even from overseas.

Yes, flexible payment plans are offered on select properties, allowing investors to manage cash flow while generating rental income from day one.

The UAE real estate market is highly regulated, with transparent legal processes and developer guarantees, providing a secure environment for your investment.

Yes, prime locations and high-demand areas typically see strong capital growth over time, driven by infrastructure development and market demand.

Our team guides you from property selection to purchase, legal formalities, and handover, ensuring a smooth and profitable investment journey.